Onlyfans Tax Form 2026 Archive Video & Foto Full Link

Start Streaming onlyfans tax form exclusive webcast. No hidden costs on our digital library. Engage with in a broad range of films unveiled in cinema-grade picture, flawless for passionate watching buffs. With the freshest picks, you’ll always remain up-to-date. Find onlyfans tax form personalized streaming in stunning resolution for a sensory delight. Get involved with our creator circle today to look at solely available premium media with for free, no subscription required. Look forward to constant updates and venture into a collection of distinctive producer content conceptualized for superior media connoisseurs. Be certain to experience one-of-a-kind films—download now with speed! Witness the ultimate onlyfans tax form one-of-a-kind creator videos with vivid imagery and editor's choices.

Onlyfans taxes giving you a hard time It shows the total amount of money you made from a particular source, in this case, onlyfans, in a calendar year. Learn how to get your 1099 form from onlyfans and file taxes as a content creator

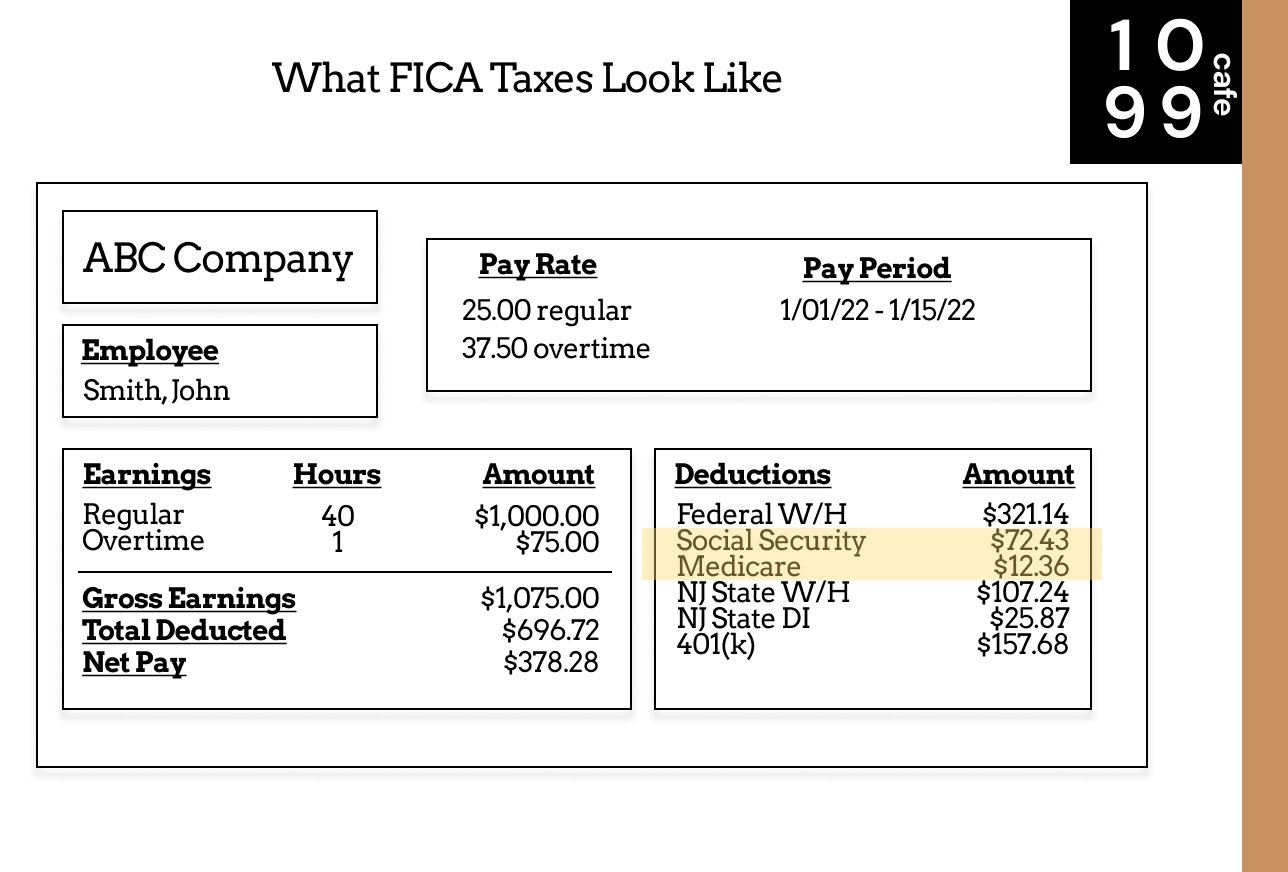

OnlyFans Taxes in 2024 | A Comprehensive Guide — 1099 Cafe

Onlyfans has become a major platform for content creators, transferring an estimated $3 billion to its workers by 2021 Avoid penalties by adhering to irs regulations. You can reduce your taxable income by deducting eligible.

This guide explains important tax considerations for u.s

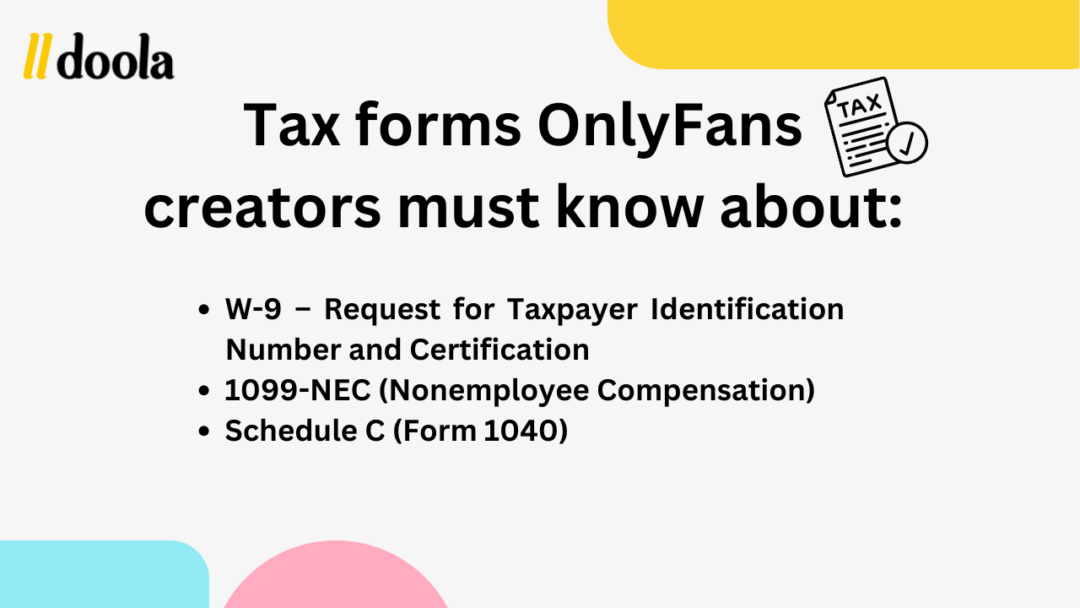

Includes forms, tools, and a free tax checklist. This form is also sent to the irs, ensuring the income is documented for tax purposes Are you stressed about how to file onlyfans taxes correctly and save your cash This blog breaks down clear steps—like finding the right tax forms and deducting smart business expenses —to help slash what you owe in 2025

Keep reading to pay less! Here are the key ones This is the standard individual tax return form It's where you'll list your onlyfans earnings and any deductible expenses

Find out how to properly report your onlyfans income, including the forms you must use, how to submit schedule c, and the deductions that are available to creators