How Do Taxes Work With Onlyfans Full Collection Media Files Link

Play Now how do taxes work with onlyfans premier digital media. No strings attached on our video archive. Explore deep in a broad range of films featured in excellent clarity, the best choice for discerning viewing enthusiasts. With just-released media, you’ll always be ahead of the curve. Uncover how do taxes work with onlyfans expertly chosen streaming in vibrant resolution for a sensory delight. Sign up for our online theater today to browse exclusive premium content with 100% free, free to access. Be happy with constant refreshments and delve into an ocean of exclusive user-generated videos created for high-quality media buffs. Act now to see never-before-seen footage—get it in seconds! See the very best from how do taxes work with onlyfans singular artist creations with brilliant quality and select recommendations.

Onlyfans has become a major platform for content creators, transferring an estimated $3 billion to its workers by 2021 But there's a catch—these expenses must be both ordinary (something that is common in your line of work) and necessary (helpful and appropriate for your business). You can reduce your taxable income by deducting eligible.

How does taxes work with OnlyFans? - The Ultimate OnlyFans Alternative

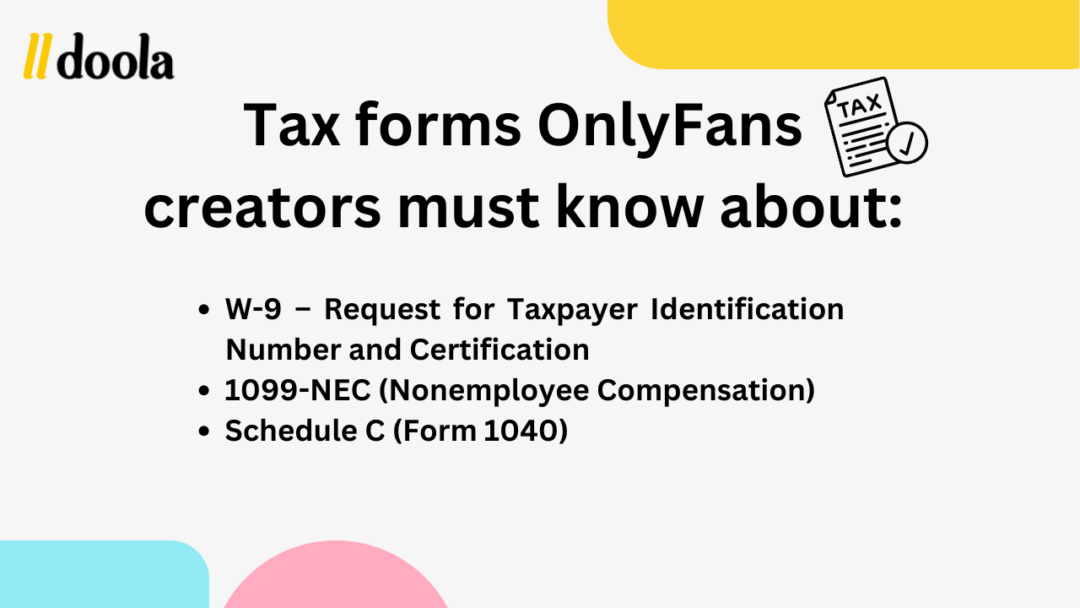

Includes forms, tools, and a free tax checklist. This means you'll pay less in taxes Onlyfans taxes giving you a hard time

This guide explains important tax considerations for u.s

Demystify your tax obligations with our comprehensive guide on whether you need to pay taxes on your onlyfans income Learn everything you need to know This article covers income reporting, deductions, and filing tips for creators in 2024. But how does onlyfans show up on tax returns

This guide will break down how onlyfans income appears on tax documents, how much tax you owe, what deductions you can take, and how to stay compliant with irs tax laws. How do onlyfans taxes work Your agi is your income after deducting business expenses, student loan interest, and qualifying irs tax credits If onlyfans is your primary income, you can deduct relevant business expenses

For example, if you earn $64,000 from onlyfans and deduct $14,000 in expenses, your agi becomes $50,000

These deductions can lower your tax bracket and reduce your overall.