How Do Taxes Work With Onlyfans Full Collection Video & Foto Full Link

Watch For Free how do taxes work with onlyfans world-class video streaming. 100% on us on our content hub. Engage with in a broad range of content offered in flawless visuals, the best choice for premium watching connoisseurs. With the latest videos, you’ll always get the latest. See how do taxes work with onlyfans tailored streaming in high-fidelity visuals for a genuinely engaging time. Hop on board our content portal today to stream solely available premium media with cost-free, no recurring fees. Get frequent new content and browse a massive selection of distinctive producer content built for premium media buffs. Seize the opportunity for unseen videos—save it to your device instantly! Witness the ultimate how do taxes work with onlyfans exclusive user-generated videos with rich colors and featured choices.

Onlyfans has become a major platform for content creators, transferring an estimated $3 billion to its workers by 2021 But there's a catch—these expenses must be both ordinary (something that is common in your line of work) and necessary (helpful and appropriate for your business). You can reduce your taxable income by deducting eligible.

How does taxes work with OnlyFans? - The Ultimate OnlyFans Alternative

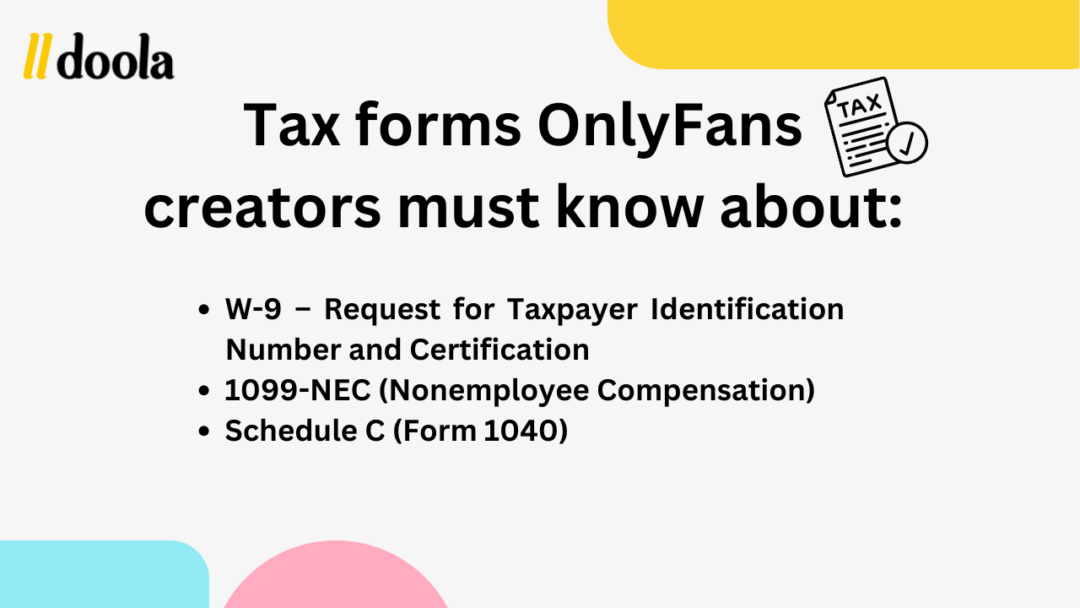

Includes forms, tools, and a free tax checklist. This means you'll pay less in taxes Onlyfans taxes giving you a hard time

This guide explains important tax considerations for u.s

Demystify your tax obligations with our comprehensive guide on whether you need to pay taxes on your onlyfans income Learn everything you need to know This article covers income reporting, deductions, and filing tips for creators in 2024. But how does onlyfans show up on tax returns

This guide will break down how onlyfans income appears on tax documents, how much tax you owe, what deductions you can take, and how to stay compliant with irs tax laws. How do onlyfans taxes work Your agi is your income after deducting business expenses, student loan interest, and qualifying irs tax credits If onlyfans is your primary income, you can deduct relevant business expenses

For example, if you earn $64,000 from onlyfans and deduct $14,000 in expenses, your agi becomes $50,000

These deductions can lower your tax bracket and reduce your overall.